PagBank Banco, Cartão e Conta

Rating: 0.00 (Votes:

0)

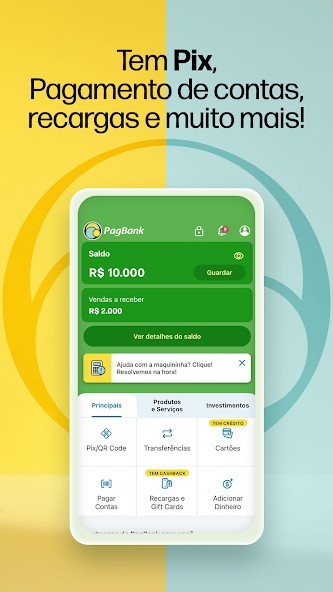

PagBank is the complete bank, with a free digital account, a credit card that you use the limit while your money earns, a free PJ account and much more.Free credit card, with no annual fee, with a limit released on the spot and without credit analysis, even for negative credit cards.

Just invest in one of the PagBank CDBs, which yield much more than savings or reserve your account balance. Each real reserved becomes a limit on the card.Payment of Bills and Boletos with installments, Pix, anticipation of FGTS birthday withdrawal with cash on time, payroll loans, cell phone recharge and much more

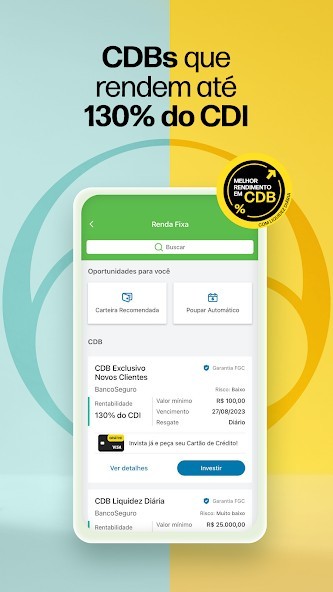

Invest in CDBs that yield more than twice the savings and with daily liquidity, direct treasury, investment funds with cashback, shares and much more in the app.

Everything for those who need to sell and undertake. Machines with zero fee and cash on the spot, QR Code Pix, online sales, social media, loyalty program. Here's everything for you to sell and for your money to yield.

income account:

Conta Rendeira is a totally free and complete PagBank digital account!

In it, your money yields much more than savings without you doing anything. Left money in the account, yields 100% of the CDI.

And you can still apply for a free credit card, without credit analysis, even if you are negative. And you decide your limit. Just reserve the money in your account and ask for your credit card. The more money you set aside, the higher your limit.

PJ Account:

Have a complete and free PJ account for your 100% digital business, with all the services your company needs and the money stopped in the PJ account yields much more than savings without you doing anything.

Ideal for entrepreneurs looking for ease in everyday life with unlimited Pix, bill and tax payments, business management, investments, free credit and debit cards and much more.

In addition to the account, we have the most complete line of machines and management application so that your company continues to sell and grow more and more.

Investments:

PagBank has the best investments for you to make your emergency reserve or to save money for your goals, to buy a house, a car, take a trip or whatever you want.

We have CDBs that yield more than twice the savings and with daily liquidity, direct treasury, investment funds with cashback, shares and much more that are available to Individuals and Legal Entities!

CDB PagBank is the best investment for your emergency reserve. You apply from R$1, it yields much more than savings, you can redeem it whenever you want and you can even have a free credit card.

If you invest in CDB PagBank, you get an international credit card, with no credit analysis and no annual fee. Applied turned limit. Invested R$1,000, get R$1,000 limit.

Through the app, you can access suggested portfolios, portfolios by investor profile and consume content related to the subject of financial education, thinking about helping you make decisions about which investment is best for your goals.

There are many options for you who want to invest in your dreams! Get started today with options starting at R$1.00!

Card Machines:

PagBank has the best machines.

Get your moderninha or minizinha with zero fee, no rent or membership fee, 5 years warranty, free shipping, several receiving options: PIX, QR Code, all debit, credit and meal flags and you still receive money from your sales on time.

Thought little machine, thought PagBank

Service Recharge:

Recharge your cell phone, various online subscription services, games, prepaid TV and app transportation, without leaving home!

Also, get 2% back on all mobile top-ups and schedule your next top-ups.

*Check availability and offer information at: https://pagbank.com.br/.

User ReviewsAdd Comment & Review

Based on 0

Votes and 0 User Reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

Other Apps in This Category